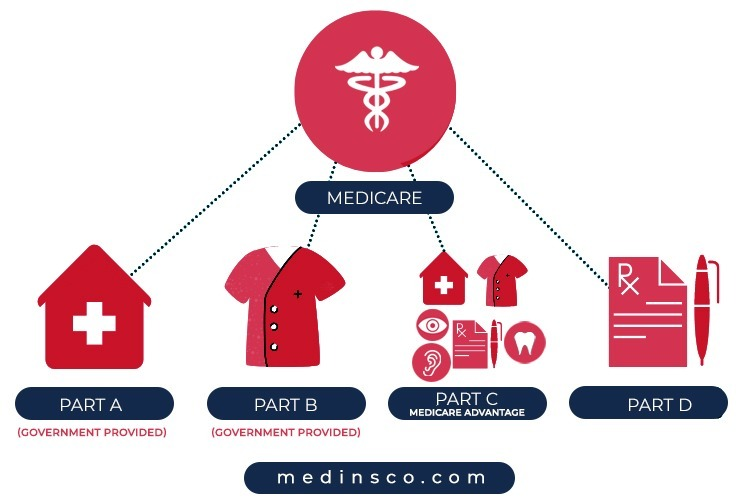

Parts / Penalties of Medicare

Medicare has 4 parts:

The majority of the time, Parts A and B are purchased together. Together they’re both called Original Medicare and are usually required to enroll in any additional Medicare coverage. Learn How to avoid Medicare late enrollment penalty

Part A (Hospital Coverage)

Part A (Hospital Coverage) – is government provided and usually free for majority of people, if there is a premium the cost is determined based off an individual’s work history. If you have to buy Part A, and you don’t buy it when you’re first eligible for Medicare, your monthly premium may go up 10%. You’ll have to pay the higher premium for twice the number of years you didn’t sign up.

- Inpatient hospital care

- Nursing facility care

- Nursing home care

- Hospice care

- Services for Home Health Care

*Social Security counts each calendar quarter (quarter = three months) that you work and pay into Social Security and Medicare taxes toward your eligibility for premium-free Part A.

*If Married, and you don’t have a work history but your spouse does, your spouse’s work history counts towards yours as well.

Part B (Medical Coverage)

Part B (Medical Coverage) – is government provided and has a premium which is based off an individual’s income. If you don’t get Part B when you’re first eligible, your monthly premium may go up 10% for each 12-month period you could’ve had Part B. You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these:

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

- If you don’t get these benefit payments, you should get a bill.

Part B Covers

- Most doctor services (including most doctor services while you're a hospital inpatient)

- Outpatient therapy

- Durable Medical Equipment (Dme)

*Some people qualify for Medicare Savings Programs to help with Part B premiums

How to Apply for Part A and/or B if you don’t have it?

PART C – Medicare Advantage Plans

As part of Medicare, you may have the option of enrolling in a Medicare Advantage Plan. These plans, often known as ‘Part C’, ‘MA/MAPD Plans’, or ‘All-In-One Plans’ are provided by Medicare-approved Insurance Carriers. Premiums are set at a fixed rate regardless of age and some plans even being premium-free. Part C is optional.

If you enroll in a Medicare Advantage Plan, you must be enrolled in Part A AND B by continuing to pay your Medicare Part B premium, as well as any plan-specific premiums (if any).

Most also include the following along with the Part A and B Coverage:

- Vision, hearing, dental, and/or health and wellness programs are examples of optional coverage (these benefits are not offered in Original Medicare)

- Drug Coverage (Part D) is included in most plans

- Plans may have lower co-pays/coinsurance costs than Original Medicare

- Plans have a yearly limit on what you pay out of pocket, once reached you will pay nothing for Part A and B services (this is not offered in Original Medicare)

PART D – Prescription Drug Plan

Medicare Part D simply put is coverage for your medication needs. Medicare Part D is for people who are not enrolled in a Medicare Advantage Plan (as most of them include it) and have Part A and/or Part B.

Although Part D is optional, if you do not purchase Part D with Original Medicare, a Medicare Advantage Plan or have some other type of Creditable Coverage by the time you are 65 you will not have Prescription coverage and also be subject to a penalty.

Medicare calculates the penalty by multiplying 1% of the “national base beneficiary premium” ($33.06 in 2021) times the number of full, uncovered months you didn’t have Part D or creditable coverage. The monthly premium is rounded to the nearest $.10 and added to your monthly Part D premium.

The national base beneficiary premium may change each year, so your penalty amount may also change each year.

*If you have limited income and resources, your state may help you pay for Part A, and/or Part B. You may also qualify for Extra Help to pay for your Medicare prescription drug coverage. Contact Us for more information about this.

OVERVIEW OF WHICH PARTS OF MEDICARE HAVE PENALTIES IF YOU DO NOT GET IT WHEN FIRST ELIGIBLE:

- 1. PART A (USUALLY FREE)

- 2.PART B (HAS A PREMIUM)

- 3. PART D (HAS A PREMIUM)