Medicare Advantage vs Original Medicare

Navigating the world of Medicare can be challenging, especially when faced with decisions about choosing between Medicare Advantage and Original Medicare. Each option has its own benefits, costs, and coverage differences, making it essential to understand what works best for your unique healthcare needs in 2025. Let’s break down both options to help you make an informed decision.

What is Original Medicare?

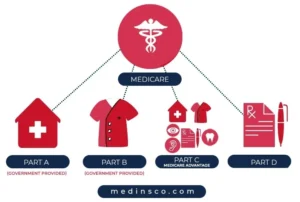

Original Medicare is the federal health insurance program consisting of two parts:

- Part A (Hospital Insurance): Covers inpatient care in hospitals, skilled nursing facility care, hospice, and some home health services.

- Part B (Medical Insurance): Covers outpatient care, doctor visits, preventive services, and medical equipment.

Original Medicare is generally preferred for those who want the freedom to choose any doctor or hospital that accepts Medicare. However, there are gaps in its coverage, such as prescription drugs, dental, vision, and hearing, which often lead beneficiaries to purchase Medicare Supplement Insurance (Medigap) to cover additional out-of-pocket costs.

What is Medicare Advantage?

Medicare Advantage (Part C) is an alternative to Original Medicare. These are private health plans approved by Medicare that bundle together Parts A, B, and often Part D (prescription drug coverage). Medicare Advantage plans may offer extra benefits such as dental, vision, hearing, and wellness programs, which Original Medicare doesn’t cover.

Medicare Advantage plans often come with lower upfront costs but may require using a network of doctors and hospitals. The trade-off is that while premiums may be lower, out-of-pocket costs may vary based on your healthcare usage.

Key Differences Between Medicare Advantage and Original Medicare

| Feature | Original Medicare | Medicare Advantage |

| Coverage | Part A and Part B (can add Part D and Medigap) | Combines Part A, B, and usually D; extra benefits |

| Doctor/Provider Access | Any doctor/hospital that accepts Medicare | Must use network providers (HMO/PPO plans) |

| Out-of-Pocket Costs | No limit on annual out-of-pocket expenses | Has annual out-of-pocket maximums |

| Prescription Drugs | Not covered (need separate Part D plan) | Usually included |

| Premium Costs | Generally higher if you add Medigap and Part D | Lower premiums but potentially higher copays |

| Extra Benefits (Dental, Vision) | Not covered | Often included |

Pros and Cons of Each Option

Pros of Original Medicare:

- Flexibility: You can visit any doctor or hospital that accepts Medicare.

- No Network Restrictions: No need to stay within a specific network of providers.

- Consistent Costs: With Medigap, you can avoid unpredictable out-of-pocket costs.

Cons of Original Medicare:

- Limited Coverage: No coverage for routine dental, vision, or hearing care.

- Higher Costs for Comprehensive Coverage: You’ll need to purchase separate plans (Medigap, Part D) to fill gaps.

Pros of Medicare Advantage:

- Extra Benefits: Includes services like dental, vision, hearing, and wellness programs.

- Cost Savings: Lower monthly premiums compared to Original Medicare + Medigap.

- Out-of-Pocket Maximums: Helps cap your healthcare spending annually.

Cons of Medicare Advantage:

- Network Restrictions: Requires you to stay within the plan’s network of providers.

Prior Authorization: Some plans may require you to get prior authorization certain services, like surgery, home health care.etc

How to Choose the Right Plan for You

- Assess Your Healthcare Needs: Do you regularly visit specialists, or have you been diagnosed with chronic conditions?

- Look at Your Budget: Medicare Advantage plans may offer savings if you are relatively healthy and don’t mind provider network restrictions.

- Check Provider Networks: If you have specific doctors or hospitals you prefer, ensure they are part of the Medicare Advantage plan’s network.

- Prescription Drug Coverage: If you take regular medications, check whether your prescriptions are covered under a Medicare Advantage plan or if you’ll need a separate Part D plan with Original Medicare.

- Additional Benefits: If dental, vision, or hearing care is important to you, Medicare Advantage might provide better coverage.

Conclusion

Deciding between Medicare Advantage and Original Medicare in 2025 comes down to your healthcare needs, preferences, and budget. Original Medicare offers flexibility and nationwide provider access, while Medicare Advantage plans often provide more comprehensive benefits at a lower upfront cost. By weighing the pros and cons of each option, you can find the Medicare coverage that best fits your healthcare requirements in the upcoming year.