Medicare 101

Your Guide to Medicare and Your Coverage Options

Navigating Medicare can seem overwhelming, but understanding the different parts and plans is essential for making the best decisions about your healthcare. At Medinsco, we are committed to helping you understand Medicare, its various components, and how to choose the best coverage for your needs. This guide provides a clear overview of Medicare and its components.

What is Medicare?

The Parts of Medicare

Medicare Part A (Hospital Insurance)

Coverage Includes:

Medicare Part B (Medical Insurance)

Coverage Includes:

Medicare Part D (Prescription Drug Coverage)

Part D helps cover prescription drug costs and is offered by private insurance companies. It requires a separate monthly premium, and plans have formularies that list covered drugs. You may also face copayments or coinsurance for prescriptions.

Coverage Includes:

- Prescription medications

- Specific drug lists (formularies) that vary by plan

- Varying costs based on plan and medication

Comparing Medicare Options

Original Medicare vs. Medicare Advantage

Original Medicare:

Medicare Advantage (Part C):

Medicare Supplement Insurance (Medigap)

Benefits of Medigap:

- Covers out-of-pocket costs not covered by Original Medicare

- Allows access to any doctor or hospital that accepts Medicare

- Does not include prescription drug coverage (Part D must be purchased separately)

- Standardized plans make comparison easier

Key Considerations for Choosing Medicare Coverage

Assess Your Healthcare Needs:

Consider your health status, the frequency of doctor visits, and ongoing medical conditions.

Budget Wisely:

Evaluate your ability to cover premiums, deductibles, copayments, and coinsurance.

Provider Networks:

- Decide whether you prefer the flexibility of Original Medicare or are comfortable with the restrictions of a Medicare Advantage plan.

Additional Benefits:

Determine if you need benefits such as dental, vision, or hearing coverage, which may be included in Medicare Advantage plans but not in Original Medicare.

Enrollment Periods (Medigap)

Understanding the enrollment periods is crucial for selecting and changing Medicare coverage:

Initial Enrollment Period (IEP)

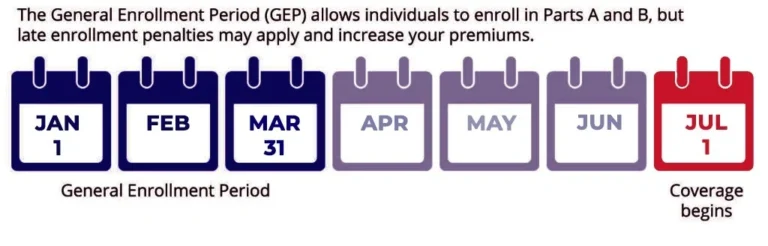

General Enrollment Period (GEP)

If you missed your IEP, you can enroll in Part A and/or Part B from January 1 to March 31 each year, with coverage starting on July 1. Note that late enrollment penalties may apply.

Medicare Advantage Open Enrollment Period:

From January 1 to March 31, you can switch Medicare Advantage plans or return to Original Medicare.

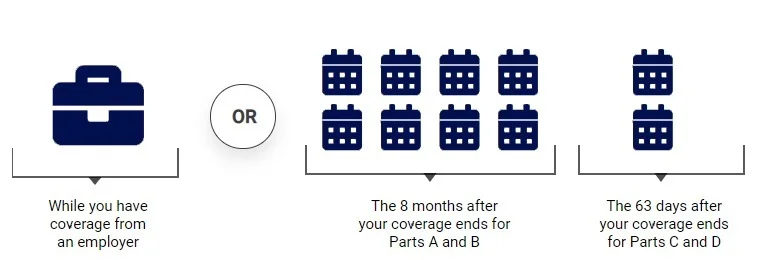

Special Enrollment Periods (SEP):

Available for specific life events such as moving, losing other coverage, or qualifying for Medicaid.

Making Your Decision

Choosing the right Medicare plan requires careful consideration of your healthcare needs, budget, and preferences. Use the resources available at Medinsco to compare plan options, check provider networks, and find the coverage that best suits you.

For personalized assistance and guidance through the enrollment process, contact Medinsco. Our team of experts is here to help you understand your Medicare options and make informed decisions about your healthcare coverage. Explore your options today and secure the right Medicare plan for your needs.