Enrollment Options for Over 65

More than likely you are enrolled as a Medicare beneficiary and you’ve probably realized that Medicare changes every year. It adjusts your premiums and deductibles and this in turn causes updates to your chosen Medicare insurance plan. Don’t worry that’s what we’re here for, it’s our job to help you understand the different plans so you can make the right choice. If you’re not already enrolled into Medicare we can certainly help you find the right plan and get you started!

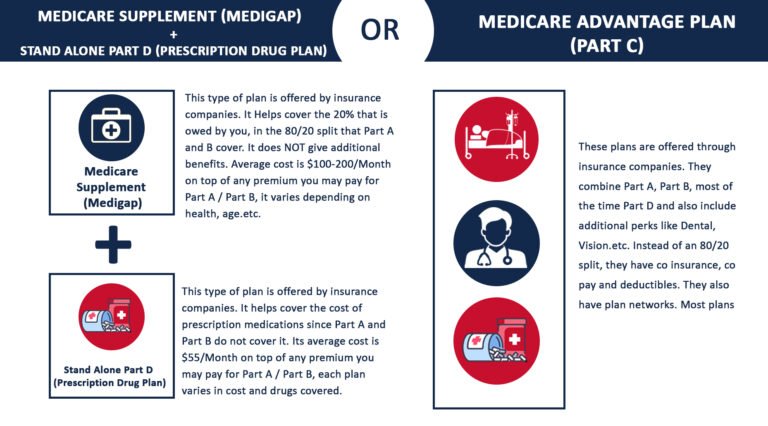

Medicare Advantage Plan (Part C) or Original Medicare with Medicare Supplement / Stand Alone Part D Plan

Medicare Advantage Plan (Part C)

As part of Medicare, you may have the option of enrolling in a Medicare Advantage Plan. These plans, often known as ‘Part C’, ‘MA/MAPD Plans’, or ‘All-In-One Plans’ are provided by Medicare-approved Insurance Carriers. Premiums are set at a fixed rate regardless of age and some plans even being premium-free.

- If you enroll in a Medicare Advantage Plan, you must continue to pay your Medicare Part B premium, as well as any plan-specific premiums (if any).

- A Medicare Supplement Insurance Plan and a Medicare Advantage Plan cannot be purchased at the same time.

Most also include the following along with the Part A and B Coverage:

Vision, hearing, dental, and/or health and wellness programs are examples of optional coverage (these benefits are not offered in Original Medicare).

Drug Coverage (Part D) is included in most plans.

Plans may have lower co-pays/coinsurance costs than Original Medicare.

Plans have a yearly limit on what you pay out of pocket, once reached you will pay nothing for Part A and B services (this is not offered in Original Medicare).

These services are subject to a variety of copays, coinsurance, and deductibles, depending on the plan.

Most also include the following along with the Part A and B Coverage:

Vision, hearing, dental, and/or health and wellness programs are examples of optional coverage (these benefits are not offered in Original Medicare) .

Drug Coverage (Part D) is included in most plans

Plans may have lower co-pays/coinsurance costs than Original Medicare.

Plans have a yearly limit on what you pay out of pocket, once reached you will pay nothing for Part A and B services (this is not offered in Original Medicare).

These services are subject to a variety of copays, coinsurance, and deductibles, depending on the plan.

Original Medicare

Medicare Supplement Plan (MediGap)?

Medigap is Medicare Supplement Insurance that helps fill “gaps” in Original Medicare. (Original Medicare is only Part A and B) and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

- Copayments

- Coinsurance

- Deductibles

Other things to know about Medigap policies:

- You must have Medicare Part A and Part B:

- You don’t technically need Medicare Part B to enroll in a Medicare Supplement plan, however without it, your supplement won’t cover any of your outpatient costs. Ultimately, it’s not likely to be cost-efficient to have a Medicare Supplement plan without Medicare Part B, and it isn’t recommended.

- You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare.

- Some Medigap policies also cover services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S

Medicare Supplement Plans are optional.

Part D

Medicare Part D simply put is coverage for your medication needs. Medicare Part D is for people who are not enrolled in a Medicare Advantage Plan (as most of them include it) and have Part A and/or Part B. Some people pair Part D and a Medicare Supplement together or simply just have Original Medicare with Part D.

Although Part D is optional, if you do not purchase Part D with Original Medicare, a Medicare Advantage Plan or have some other type of Creditable Coverage by the time you are 65 you will be subject to a penalty.

The national base beneficiary premium may change each year, so your penalty amount may also change each year.