Are you

Turning 65?

Turning 65? It’s a major milestone and the perfect time to secure the right Medicare coverage. Ensuring you’re enrolled in the appropriate Medicare plan is essential to avoid expensive penalties and to make sure you receive the healthcare benefits you deserve. Missing the enrollment period for Medicare Parts A, B, or D without qualifying for a special enrollment can lead to lifelong late enrollment penalties, added to your monthly premiums.

At Medinsco, we understand that transitioning to Medicare can feel overwhelming, but we’re here to simplify the process. Our goal is to provide you with all the essential details about Medicare, helping you make informed decisions that align with your healthcare needs. Let us guide you through this important journey, ensuring you have the coverage that suits you best.

Health Insurance for Those Turning 65

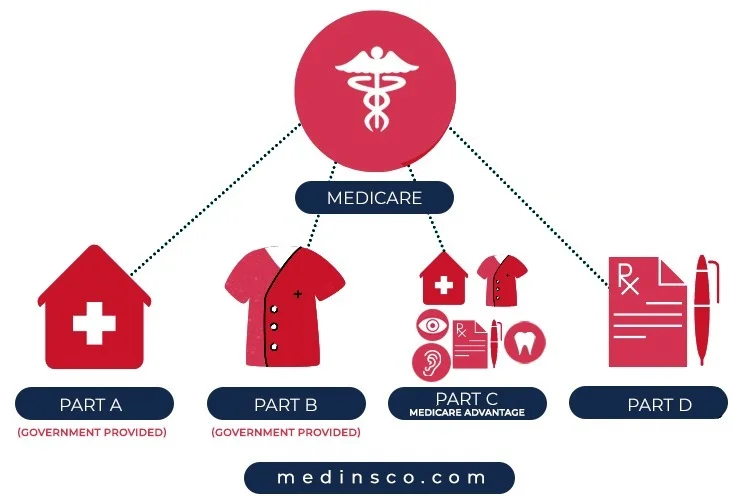

Understanding Medicare

Medicare Part A (Hospital Insurance):

- Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Most people do not pay a premium for Part A if they or their spouse have paid Medicare taxes for a certain amount of time.

Medicare Part B (Medical Insurance):

- Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Most people do not pay a premium for Part A if they or their spouse have paid Medicare taxes for a certain amount of time.

Medicare Part C (Medicare Advantage):

- Offered by private insurance companies approved by Medicare.

- Combines Part A and Part B coverage and often includes additional benefits such as prescription drugs, dental, vision, and hearing coverage.

- May require additional premiums beyond Part B.

Medicare Part D (Prescription Drug Coverage):

- Helps cover the cost of prescription drugs.

- Plans are offered by private insurers and require a monthly premium.

Enrolling in

Medicare

Step1:

Understand Your Initial Enrollment Period (IEP)

Your IEP is a seven-month period that begins three months before the month you turn 65, includes your birthday month, and ends three months after.

It’s crucial to enroll during this period to avoid late enrollment penalties and ensure your coverage starts promptly.

Step 2:

Evaluate Your Healthcare Needs

Consider your current health status, medications, and the healthcare services you use regularly.

Determine whether Original Medicare (Parts A and B) or a Medicare Advantage plan (Part C) best meets your needs.

Step 3:

Compare Plans and Costs

Use our online tools and resources to compare different Medicare plans available in your area.

Look at the coverage options, provider networks, out-of-pocket costs, and additional benefits each plan offers.

Step 4:

Apply and Enroll

Apply for Medicare through the Social Security Administration, either online, over the phone, or in person at a local office.

If choosing a Medicare Advantage or Part D plan, you’ll need to enroll separately through the plan provider.

Why Choose Medinsco?

At Medinsco, we are dedicated to making your transition to Medicare as smooth as possible. Here’s why you should trust us with your Medicare needs

Expert Guidance

Our experienced team provides personalized advice tailored to your specific healthcare needs and budget.

Comprehensive Support

From understanding your initial enrollment period to comparing plans and completing your application, we support you at every step.

Customer-Centric Approach

We prioritize your health and financial well-being, ensuring you have the coverage you need without unnecessary stress.

Additional Medicare Options

Medicare Supplement Insurance (Medigap):

- Helps cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

- Offered by private insurance companies and requires an additional premium.

Stand Alone Prescription Drug Coverage (Part D):

- Part D of Medicare is a prescription drug coverage plan that helps beneficiaries pay for medications.

- Offered by private insurance companies and requires an additional premium.

- Enrollment in Part D is optional, and there are penalties for late enrollment.

- Some Medicare Advantage Plans include Part D coverage at no additional cost.

Stand Alone Prescription Drug Coverage (Part D):

- Part D of Medicare is a prescription drug coverage plan that helps beneficiaries pay for medications.

- Offered by private insurance companies and requires an additional premium.

- Enrollment in Part D is optional, and there are penalties for late enrollment.

- Some Medicare Advantage Plans include Part D coverage at no additional cost.

Special Enrollment Periods (SEP):

- If you miss your IEP or have other qualifying circumstances, you may be eligible for a SEP to enroll in Medicare without penalty.

Turning 65 and transitioning to Medicare is an important step in ensuring your health and financial security. At Medinsco, we make it easy to understand your Medicare options and enroll in the right plan. Explore our website or contact us directly to learn more about your choices and start the enrollment process today. Let Medinsco be your trusted partner in securing comprehensive, affordable healthcare coverage as you enter this new chapter of life.